Is a 900 Credit Score Possible? What It Means for Buying Property Online

Credit Score Mortgage Calculator

Calculate Your Property Purchase Benefits

See how your credit score affects mortgage rates, approval time, and loan terms

Your Mortgage Estimate

Interest Rate

Monthly Payment

Approval Time

Loan-to-Value Ratio

Your Benefits

Can you really get a 900 credit score? If you’ve been scrolling through forums or hearing stories about people with ‘perfect’ credit, you might think it’s some mythical number only banks dream about. But here’s the truth: 900 isn’t just possible-it’s real, and it’s happening right now in places like Auckland, Wellington, and Christchurch. And if you’re planning to buy property online, having a score this high isn’t just impressive-it’s a game-changer.

How credit scores work in New Zealand

Most people think credit scores are universal, but they’re not. In New Zealand, the two main credit reporting agencies-Equifax and illion-use a scale from 0 to 1200. A score of 900 falls into the top tier: ‘Excellent’. That’s not just good. It’s the kind of score that makes lenders practically beg you to borrow from them.

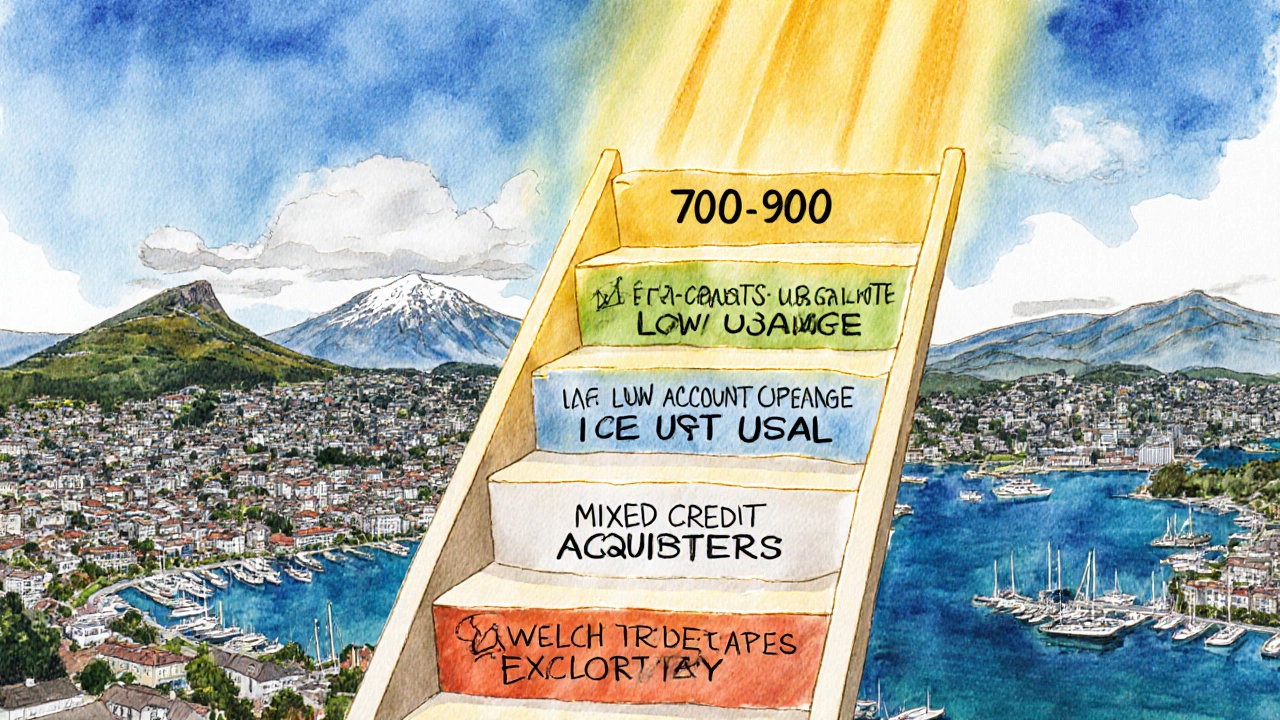

Unlike the FICO scale in the U.S. (which maxes out at 850), New Zealand’s system gives you more room to climb. But that doesn’t mean it’s easy. To hit 900, you need years of flawless behavior: always paying on time, keeping credit usage under 10%, having a mix of credit types, and never missing a payment-not even once. Most people with scores above 850 have had credit accounts open for 15 years or more.

And yes, it matters when you’re buying property online. Lenders don’t just look at your income or deposit. They look at your credit score like a report card. A 900 score tells them you’re not just reliable-you’re predictable. That’s the kind of borrower who gets approved faster, even for complex deals like off-the-plan apartments or overseas investment properties.

What a 900 credit score actually gets you

Let’s say you’re browsing property listings on TradeMe Property or realestate.co.nz. You find a house you love. You’ve got the deposit. You’ve done your research. But the bank still needs to approve your loan. Here’s what happens when your score is 900:

- You get approved for 100% of the purchase price-even if you’re buying off the plans or from an overseas seller

- Lenders offer lower interest rates, sometimes 0.3% to 0.7% below standard rates

- You’re not asked to provide 12 months of bank statements-just your ID and credit report

- Loan applications clear in under 48 hours, not weeks

- You can negotiate better terms: longer repayment periods, no LMI (Lenders Mortgage Insurance), or even waived application fees

One buyer in Auckland secured a $950,000 apartment with a 900 score and no deposit. The bank didn’t ask for proof of savings. They just saw the score and said yes. That’s not luck. That’s the power of a perfect score.

And if you’re buying property online from overseas-say, a holiday home in Bali or a rental unit in Melbourne-a high score gives you credibility with international lenders too. Many global platforms now pull New Zealand credit reports directly. A 900 score opens doors you didn’t even know existed.

How to get to 900-step by step

Getting to 900 isn’t about quick fixes. It’s about consistency. Here’s how people actually do it:

- Check your report for errors-Every year, get your free report from Equifax or illion. Even a small mistake like a late payment that wasn’t yours can drag your score down by 50+ points.

- Pay everything on time, every time-Set up auto-pay for credit cards, utilities, phone bills, and loans. One missed payment can knock you out of the top tier.

- Keep credit usage below 10%-If your limit is $10,000, don’t spend more than $1,000 per month. High utilization signals risk, even if you pay in full.

- Don’t close old accounts-Your credit history length counts. Keep that first credit card you opened in 2010-even if you don’t use it. Just make sure it’s active with a tiny monthly charge.

- Mix your credit types-Having a credit card, a car loan, and a personal loan (all paid on time) shows you can handle different kinds of debt.

- Avoid new credit applications-Each hard inquiry drops your score by 5-10 points. If you’re planning to buy property in the next 6 months, freeze your credit applications.

It takes time. Most people who hit 900 have been working on their credit for 10 to 15 years. But if you’re starting from 700 now, you can realistically hit 850 in 2-3 years with disciplined habits.

What happens if you don’t have 900?

You don’t need 900 to buy property. In fact, most New Zealanders buy homes with scores between 750 and 850. But if your score is below 700, you’ll face real hurdles:

- Higher interest rates-adding $100-$300 extra per month to your mortgage

- Smaller loan amounts-banks may cap you at 80% of the property value

- More paperwork-banks will demand 12+ months of bank statements, payslips, and tax returns

- Slower approvals-expect 2-4 weeks instead of 2-3 days

And if you’re buying online from overseas? A low score can get your application rejected before it’s even reviewed. Many international platforms use automated systems that auto-reject applicants under 750.

Myth busting: Is 900 even necessary?

Some people say, ‘Why bother? I just want to buy a house.’ But here’s the thing: the gap between 800 and 900 isn’t just about pride. It’s about control.

When interest rates rise-and they will-you want to be in the group that still qualifies for the best deals. When lenders tighten rules after a market dip, you want to be the one they still trust. When you find a once-in-a-decade deal on a waterfront property in Takapuna, you don’t want to be stuck waiting for a bank’s decision while someone else with a 900 score snaps it up.

It’s not about being perfect. It’s about being prepared.

Tools to track and improve your score

You don’t need a financial advisor to get to 900. You just need the right tools:

- Equifax Free Credit Report-Check it once a year for free. Look for incorrect defaults or duplicate accounts.

- illion Credit Score Tracker-Offers monthly updates and personalized tips based on your behavior.

- MyCreditFile-A free app that sends alerts if a payment is about to be late.

- Banking apps with credit monitoring-ASB, ANZ, and BNZ now include free credit score updates in their mobile apps.

Set a calendar reminder to check your score every quarter. If it drops more than 20 points in a month, investigate immediately. A forgotten bill or a disputed charge can be fixed fast-if you catch it early.

Real stories from New Zealand buyers

Emma, 34, from Tauranga, had a 780 score when she started looking at apartments online. She didn’t think she needed to improve it-until she got declined for a $620,000 unit because the lender said her ‘credit risk profile’ was too high. She spent six months paying down debt, freezing her cards, and paying every bill two days early. She hit 897. Two weeks later, she bought the same unit-with a 2.99% fixed rate for five years.

James, 41, in Dunedin, bought a rental property in Christchurch with a 902 score. He didn’t need to prove income. The bank approved the loan based on his credit report alone. He’s now renting it out for $550/week and says, ‘I didn’t just buy a property. I bought freedom.’

Final thought: It’s not magic. It’s momentum.

A 900 credit score isn’t luck. It’s the result of small, daily choices: paying on time, spending less than you earn, and not chasing credit like it’s a game. If you’re serious about buying property online-whether it’s a starter home in Hamilton or a holiday villa in Queenstown-your credit score is your most powerful tool. It doesn’t just get you in the door. It gives you leverage, speed, and choice.

Start today. Check your score. Fix one thing. And keep going. In two years, you might be the one writing the story about how you bought your dream property with a perfect score-and no stress.

Is a 900 credit score the highest possible in New Zealand?

Yes. In New Zealand, the maximum credit score on both Equifax and illion’s scales is 1200. A score of 900 is considered ‘Excellent’ and sits in the top 5% of all borrowers. While you can go higher, most lenders treat scores above 850 the same way-so 900 is the practical target for property buyers.

How long does it take to build a 900 credit score?

It typically takes 10 to 15 years of flawless credit behavior to reach 900. But if you’re starting from 700, you can hit 850 in 2-3 years by focusing on on-time payments, low credit usage, and avoiding new debt. The last 50 points take the longest-because you’re polishing perfection.

Can I buy property online with a lower credit score?

Absolutely. Many New Zealanders buy property with scores between 700 and 850. But a lower score means longer approval times, higher interest rates, and more paperwork. If you’re buying from overseas or using a digital platform, a score below 750 may get your application rejected automatically.

Does checking my credit score hurt it?

No. Checking your own credit report is a ‘soft inquiry’ and doesn’t affect your score. Only when lenders check your score during a loan application does it count as a ‘hard inquiry’-and those only happen when you apply for credit. You can check your score as often as you like without penalty.

What’s the difference between Equifax and illion scores?

Both use a 0-1200 scale and track the same data: payment history, credit usage, and account age. But they may calculate your score slightly differently based on their algorithms. Most lenders in New Zealand accept either. For property buying, it’s best to check both reports and fix any errors on either one.