California has the most expensive homes in the U.S. in 2026, with a median price of $912,000. Hawaii, Massachusetts, Washington, and New Jersey follow closely. High costs stem from housing shortages, zoning laws, and demand - not just luxury.

Property Buying Guide: Smart Steps to Own Your Home in Mulund

When you're thinking about buying a house, you're not just looking for four walls and a roof—you're planning a major life move. Property buying, the process of acquiring residential or commercial real estate with the intent to live in or invest in it. Also known as home purchase, it’s one of the biggest financial decisions most people ever make. In Mulund, where demand is high and options range from compact 2BHK apartments to quiet villas, knowing what to look for can save you time, money, and stress.

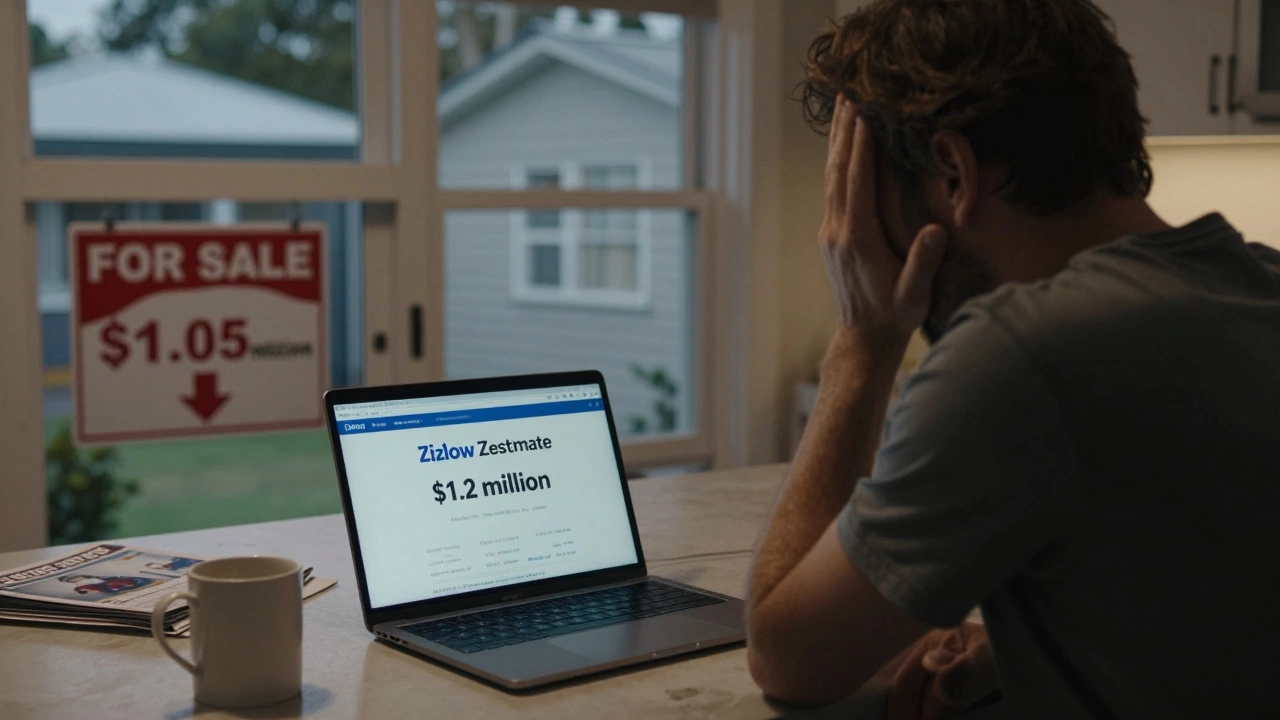

One of the biggest mistakes buyers make is ignoring the 30 rule, a simple guideline that says your total housing costs shouldn’t exceed 30% of your monthly income. This includes your mortgage, property taxes, insurance, and maintenance. Skip this, and you risk being house-rich but cash-poor. Then there’s the Zillow vs Redfin, two popular online platforms that give home value estimates but often disagree by tens of thousands of rupees. One might say your dream apartment is worth ₹80 lakh, the other says ₹72 lakh. Which one do you trust? The truth? Neither. They’re starting points. A good agent, local knowledge, and a physical walk-through matter more.

And what even counts as a good 2BHK? Some builders call a 600 sq ft unit a "luxury 2BHK," but is that enough for a family? The ideal 2BHK size, typically between 800 and 1,000 sq ft in Mumbai, gives you breathing room without overspending. Meanwhile, if you’re comparing a villa, a standalone home with private land and more control over design. Also known as detached house, it’s ideal for those who want space and privacy versus a townhouse, a shared-wall unit that’s cheaper but comes with HOA fees and less control, you’re not just choosing a building—you’re choosing a lifestyle. Villas need more upkeep. Townhouses mean less yard work but more rules.

It’s not just about size or price. Location affects value more than you think. A house near a noisy market, a power substation, or a school with bad ratings can drop your resale value by 15–20%. And if you’re thinking about waiting for the "perfect time" to buy, ask yourself: when did the perfect time ever come? Rates change. Prices rise. Inventory shrinks. The best time to buy is when you’re ready financially and emotionally—not when the market is "perfect."

What’s waiting for you below

You’ll find real talk here—not marketing fluff. We cover how much income you actually need to buy without drowning in debt. We break down why stopping mortgage payments doesn’t mean you get to live rent-free forever. We compare tools like Zillow and Redfin so you know which one to trust. We even show you what kills property value faster than bad paint. Whether you’re looking at your first 2BHK or thinking about turning a paid-off home into a rental, this guide gives you the facts you need to move forward with confidence—not fear.What Is the Best State to Live in for Property Buyers in 2026?

The best state to live in depends on your budget, job, and lifestyle. In 2026, Texas, Georgia, and Arkansas lead in affordability, tax savings, and growth. Find where your money goes furthest-not where the views are prettiest.

Is it better to rent or buy a home? The real cost breakdown in 2026

In 2026, renting vs. buying a home depends on your timeline, finances, and goals. Learn the real costs, hidden fees, and investment potential to make the right choice for your life.

How Close Is Zillow to the Actual Selling Price? Real Estate Zestimate Accuracy Explained

Zillow's Zestimate often misses the real selling price in Auckland. Learn why it's unreliable in New Zealand and how to use it wisely when buying or selling property.

Top Cons of Buying a House You Should Know

Explore the real downsides of purchasing a home, from upfront costs and mortgage debt to maintenance, market risk, and hidden expenses.

Best Size for a 2BHK Apartment - What Works Best

Discover the ideal square footage for a 2BHK, see global size benchmarks, and get a checklist to choose the perfect layout for your lifestyle.

Villa vs Townhouse: Key Differences Explained

Explore the key differences between villas and townhouses, covering definitions, costs, lifestyle, financing, and how to pick the right option for your needs.

Ideal Age to Buy a House: When Is the Right Time?

Discover how age, finances, career stability, and market factors shape the perfect time to purchase a home, with checklists, pros‑cons, and FAQs.

30 Rule for Buying a House: Your Key to Smart Homeownership

Thinking about buying a house? The 30 rule helps you figure out how much home you can actually afford so you don't get in over your head. It's simple: don't spend more than 30% of your monthly income on housing costs, including your mortgage, taxes, and insurance. This guide breaks down exactly how the rule works, why it matters, and what you need to watch out for when buying online. Get real tips to keep your home purchase stress-free and within budget.

Zillow vs Redfin: Which is Better for Buying Property Online?

Looking to buy a property and can't decide between Zillow and Redfin? This guide breaks down what sets these two real estate platforms apart, from their accuracy and tools to user experience and extra perks. Get real tips on how each site helps home shoppers, home values, and the real cost of relying on one over the other. Discover insider facts and hacks that most first-time buyers miss. Make your home search smarter, not harder.

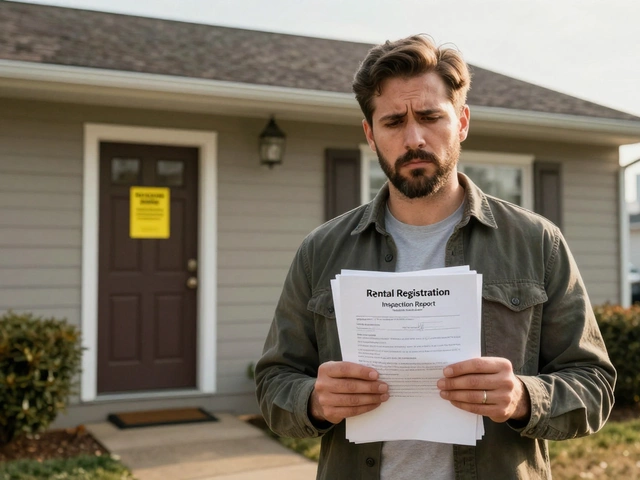

How Long Can You Live in Your House Without Paying a Mortgage?

Curious about how long you could stay in your home after you stop paying your mortgage? This article explains what really happens if you stop making those payments, how long banks usually take to start the foreclosure process, and what you should expect once the ball gets rolling. You'll learn some real timelines, tricks people use to delay things, and why it's not as simple as just staying put forever. Get smart about your rights, the risks, and why lenders act the way they do.

Zillow vs. Redfin: Who Is More Accurate with Home Values?

Zillow and Redfin both claim to have top-tier home value estimates, but which one comes closer to the real number? This article explains the ways each platform gets its data and what that means for buyers and sellers. You'll pick up tips on how to spot what’s off, when to trust online numbers, and why a human touch still matters for big decisions. If you're shopping for a home, selling, or just curious, this guide walks you through what actually matters.